Less Intense Multi-bidding and Fewer First-time Buyers in August 2021

Sep. 24, 2021 | Written by: NARLess Intense Multi-bidding and Fewer First-time Buyers in August 2021

.png)

The intense multi-bidding seen during the summer is simmering down, due in part to a seasonal decline, but also because first-time buyers are stepping away due to the lack of affordable homes. The share of first-time buyers declined to 29% in August, and the number of offers on homes that sold (closed) in August decreased to an average of 4 offers per home, according to the August REALTORS® Confidence Index report, a monthly national survey of transactions of REALTORS®.

Roughly four offers on average per home sold in August

In August, there were, on average, 3.8 offers on homes that sold during the month, down from 5.1 offers in May. But even as the number of offers has been declining, competition is still more intense than during the pre-pandemic period when the average number of offers on homes ranged from an average of 2 to 3 offers.

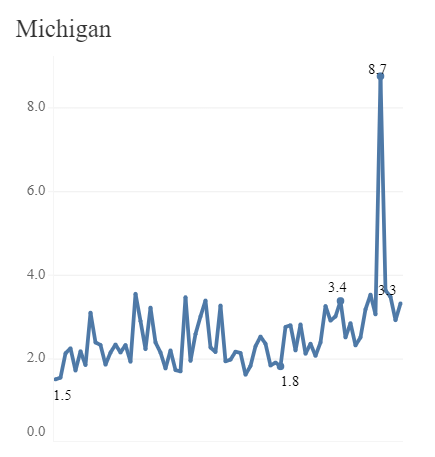

The charts below show the average number of offers on homes sold. At the state level, one can see a more significant spike in the number of offers during the summer. The largest surge in the home offers on average were in Michigan (8.7).

First-time buyer share declines to 29%

The share of first-time buyers to the total existing-home sales market declined to 29% in August 2021 from 33% in the same month in 2020. During the first eight months of 2021, the first-time buyer share averaged just 31% compared to 33% in 2020 and 32% in 2019 (pre-pandemic).

A variety of factors are causing buyers to step away: lack of affordable homes, especially at price points below $250,000 (single-family homes priced at $250,000 and below made up 29% of single-family existing-home sales in 2021 compared to 38% in 2020), lack of financial resources to meet the down payment requirements ($52,000 for a 10% down payment and 5% closing cost on a $350,000 home), and competition with cash buyers (cash sales accounted for 22% of existing-home sales compared to 18% in the same period one year ago). Among buyers, 25% also waived the appraisal contract contingency, which indicates that these buyers are not obtaining mortgage financing. In a tight market, sellers tend to prefer cash because they also need cash to make a down payment and to sell quickly so they can close quickly.

Outlook: Multi-bidding to cool as mortgage rates rise in 2022

The intense multi-bidding seen in the summer will likely continue to cool in the remaining months of 2021 and in 2022, due to rising mortgage rates. This cooling-off is good for the long-term health of the market because the multi-bidding frenzy can only further erode home affordability and push buyers out of the market.

NAR forecasts the 30-year fixed mortgage rate to rise from 3% in 2021 to 3.6% in 2022, with the Federal Reserve Board likely to start cutting back on its purchases of mortgage-backed securities in 2022 to control inflation (5.3% in August) while achieving full employment (5.2% unemployment rate in August). Rising mortgage rates will lead to a small decrease in home sales and a modest increase in home prices. Home sales are expected to decrease slightly to 5.99 million in 2022 from 6 million in 2021 while the median existing-home sales price is expected to increase to just 4.4%, a modest increase compared to the current double-digit price growth.